It's a vindictive unfair approach to taxation" says member

North Devon Council is standing shoulder to shoulder with its farmers by writing to the prime minister to oppose changes to inheritance tax which could affect hundreds of family farms in the district.

Members backed a motion put forward by Cllr Liz Bulled (Con, North Molton) to allow family farms to be exempt from the tax which will mean farmers having to pay 20 per cent on all farmland and assets over £1 million.

The Labour government plans to introduce the tax in April 2026.

Currently farmers do not incur costs when they inherit farms thanks to Agricultural Property Relief (APR) and Business Property Relief (BPR).

Labour says it wants to tax the wealthiest farms who are currently claiming most of the relief and costing the taxpayer millions.

They say the money would be better spent on public services.

But it has been estimated that 70,000 businesses, where families have farmed for generations, will also be impacted by the change and be landed with a tax bill of at least £240,000.

Retired farmer Cllr Bulled said the motion came on the back of all the work the council was doing to support local farmers.

Recently the authority waived some costs so farmers could get their planning applications dealt with more quickly and has committed to promoting local food.

It also rejected a motion put forward by a green councillor to take meat off its menus.

Cllr Bulled said it was an “extremely troubling” time for farmers and she had never known farmers so angry or so sad.

She said for a farm to be viable it needed to be more than 250 acres – meaning it would come within the 20 per cent tax bracket.

“Without farmers who produce food none of us would survive and so need to protect them for everyone’s sake,” she said.

The councillor said many people would be forced to sell land or close entirely, paving the way for corporate ownership and lifestyle buyers over family ownership.

“Farmers may appear to be rich with all the land and property they own but it’s all tied up in the business. Most receive less than the minimum wage for the hours they work and should not be saddled with a tax burden for which they have no mean to pay apart from selling their land.”

The knock-on effect to other rural businesses, the economy, environmental stewardship and farmers’ mental health would be severe, she said.

Cllr Ricky Knight (Green, Heanton Punchardon) questioned whether it was fake news when the prime minister announced that his government inherited a £22 billion black hole.

“If not, what is a government supposed to do,” he added. “Balancing the books is what our council officers have to do every day.”

Everyone was warned back in June that this budget would be painful, he said.

“It’s the default attitude to not believe what politicians say but the prime minister was absolutely sure that 73 per cent of farm estates and agricultural property will not be affected by this inheritance tax.

“Taxing the rich, the ones that own the land, the ones that use every trick in their accountant’s books to avoid and evade paying their dues is exactly what I think this is.

“This is a chance to claw back some of the effortlessly inherited wealth of those landowners – the ones that squeeze the pips out of their tenant farmers.”

It said this issue had become about political posturing between the left and right when it should be about “the haves and have nots”.

Cllr Robin Milton (Ind, Bishops Nympton) said it was a missed opportunity to address the principal problems around taxation and would not tackle big corporate investment or lifestyle buyers outpricing local buyers.

“The government needs to go and rethink this. It is a vindictive, unfair approach to taxation and it needs to come back with something that is realistic.”

He said it appeared that even the Department of the Environment, Food and Rural Affairs (Defra) and the Treasury could not agree on the figures with the former suggesting 66 per cent of farms would be effected and the latter 30 per cent.

Letters from the council opposing the tax will also be sent to chancellor Rachel Reeves and secretary of state for Defra Steve Reed.

Hundreds of farmers from Devon travelled to London on Tuesday to take part in a mass protest at Westminster.

Man's jaw corrected after Plymouth punch up

Man's jaw corrected after Plymouth punch up

Devon MP’s victory over ‘unfair’ GP funding

Devon MP’s victory over ‘unfair’ GP funding

Public donations to boost Dartmoor's accessibility

Public donations to boost Dartmoor's accessibility

Theatre launches Crowdfunder to support talent

Theatre launches Crowdfunder to support talent

Exmouth shops forced to close after tobacco raids

Exmouth shops forced to close after tobacco raids

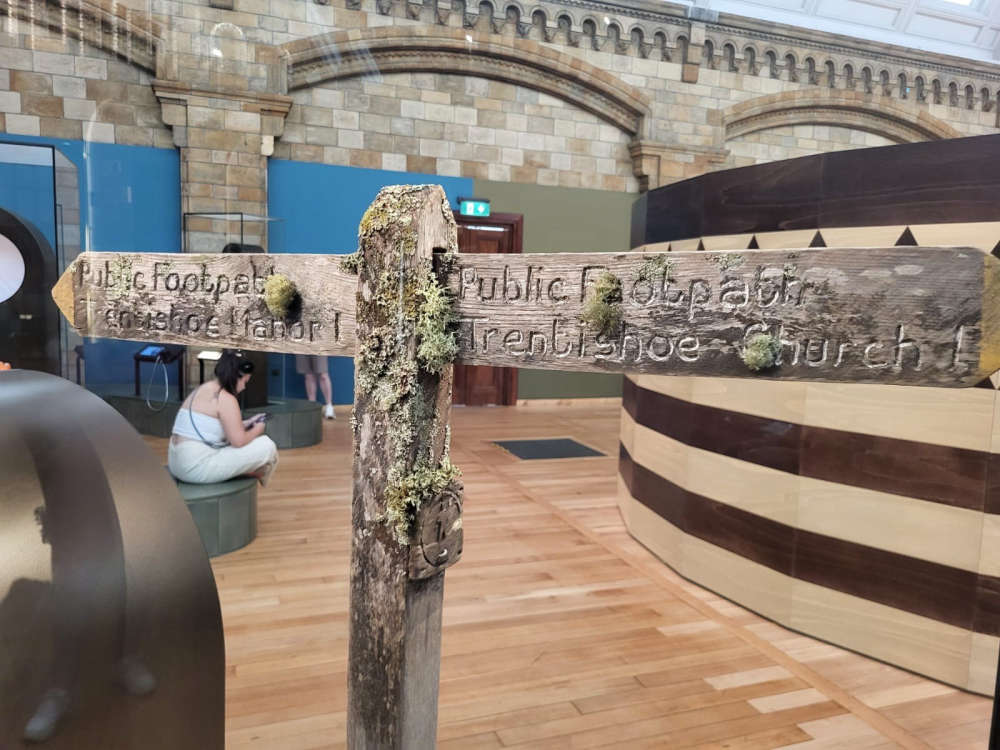

National park gives museum the finger-post

National park gives museum the finger-post