Loophole stops people being covered

The Labour MPs for Plymouth Sutton and Devonport and Exeter are calling on the Government to close a loophole which is preventing some individuals and businesses from receiving insurance cover for damage caused by World War Two bombs.

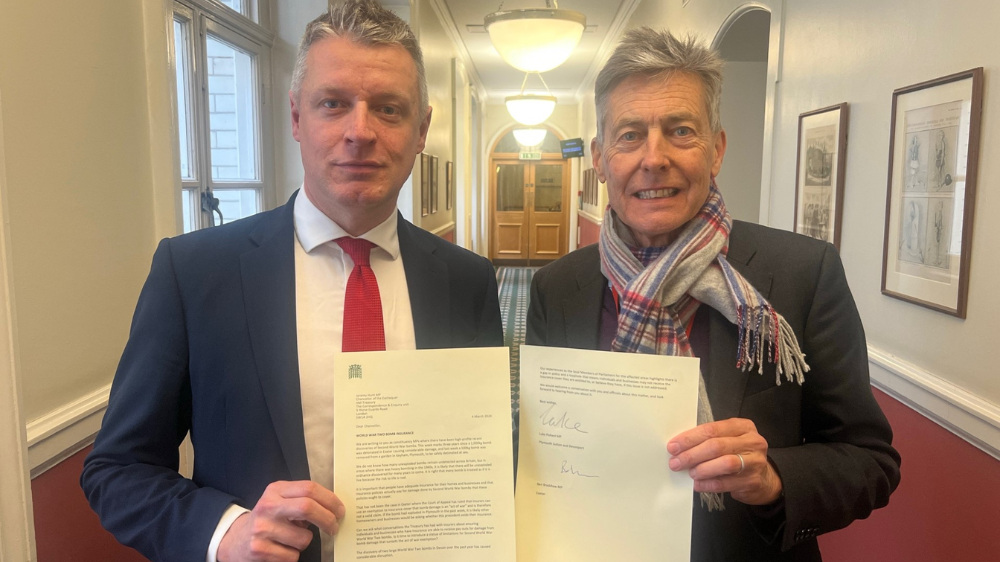

Luke Pollard and Ben Bradshaw's constituencies in Plymouth Sutton and Devonport and Exeter have both seen recent high-profile discoveries of Second World War bombs. The Devon MPs have sent a joint letter to the Chancellor, asking the Treasury to review whether a statue of limitations for Second War bomb damage is needed to exempt damage deemed by insurers as an "act of war."

Last month, more than 10,000 people were evacuated from Keyham, Plymouth when a 500kg unexploded bomb was removed and safely detonated at sea. The operation to remove the bomb has reportedly caused damage to some of the properties in close proximity to where the bomb was found in a garden on St Michael Avenue.

Three years earlier, a 1,000kg bomb was found and detonated at a site near the University of Exeter, causing considerable damage to university buildings and halls of residence.

In December 2023, the University of Exeter lost its appeal to get an insurance payout for the damage caused by the exploded device, after the Court of Appeal ruled the damage caused was within the scope of a "war exclusion" clause Allianz Insurance.

Luke Pollard, Member of Parliament for Plymouth Sutton and Devonport, said:

"There are almost certainly other World War Two bombs out there, waiting to be discovered and each one has the potential to kill and destroy property. That’s why closing this insurance loophole makes so much sense.

"After the discovery of two large bombs in Devon over the past few years, it seems sensible to learn the lessons from our experiences. People should know that in the event of the worst happening, their insurance will cover them.

"What Ben and I are asking for is a small change that makes the world of difference if you’re suddenly affected.”

Ben Bradshaw, Member of Parliament for Exeter, added:

"I have serious public policy concerns about the insurance industry and the potentially serious consequences of a lack of redress and effective cover for businesses and private citizens who are victims of events that are entirely outside of their control.

"Most people would think it extraordinary that insurers can wriggle out of responsibility by using an “act of war” get out clause for a conflict that ended nearly 80 years ago."

Re-elected PCC to prioritise ‘limbo’ chief constable situation

Re-elected PCC to prioritise ‘limbo’ chief constable situation

Exeter Cathedral abseil raises over £50,000

Exeter Cathedral abseil raises over £50,000

Moves made to avoid controversial estate management firms

Moves made to avoid controversial estate management firms

Turnout for police and crime commissioner election drops as count continues

Turnout for police and crime commissioner election drops as count continues

How Exeter's traffic troubles influenced council vote

How Exeter's traffic troubles influenced council vote

Alison Hernandez secures third term as police and crime commissioner

Alison Hernandez secures third term as police and crime commissioner