Council deal done quickly to avoid competition

Questions have been raised by East Devon councillors about why the council spent nearly £3 million buying Exmouth's seafront development 'Ocean' this year, despite many councillors not knowing about it.

The centre, which was dogged by delays when it was constructed in the late 2000s, was originally known as the 'bowling alley' and now houses a soft play area, two restaurants as well as bowling. It is also marketed as a wedding venue. It is operated by a company called Leisure East Devon, which also runs leisure centres across the district. The building was acquired in March for £2.7 million, but the reasoning and the process was only presented to councillors last week.

Cllr Kevin Blakey, who at the time of the purchase was the portfolio holder for economy, said that the decision was taken quickly under agreed commercial investment frameworks to avoid competitors coming in to "gazump our position."

He added: “We had a chance to make a sensible investment that brings in money for the council and had this been out in the wider world, we may have lost that. It was not an attempt to play secret squirrels and keep the council in the dark, but for good sounds reasons, and I would not do anything different now.”

Tim Child, senior property and estates manager for the council said that the council also own adjacent land and has opportunities to unlock potential of the wider area encompassing Queens Drive, Harbour View Café and Ocean into one ‘offering’. He added: “The business case to invest was based on the income stream from LED but for the reasons mentioned, other opportunities are open to EDDC that would not have been open to other purchasers and hence the investment is worth more to EDDC than other purchasers.

“There is a forecast net income in year 1 of £79,000 which represents a return of 2.79 per cent increasing to £99,000 (est) and 3.47 per cent in year 2 and if a more cautious approach is taken to EDDC maintenance liabilities then a net income of £49,000 representing 1.73 per cent increasing to £68,000 (est) and 2.40 per cent in year 2. These rates of return are after borrowing costs and do not reflect possible enhancement in capital values.”

Cllr Geoff Pook, the then portfolio holder for asset management, added: “It was a commercial property investment, the due diligence was done and it had a value of the income it was generating. We did go through the process and it was the one that was agreed. This is a key development on Exmouth seafront and to own it and controlling it seemed to be a good thing for EDDC to control the development that goes ahead.”

But Cllr John Loudoun said that it was disappointing that seven months after the acquisition, this was the first time they had the chance to find out what they have done and for what reason.

Cllr Paul Arnott, leader of the council, said: “It is extraordinary that the council made this purchase and the only knowledge we had of it was with a press release. The point is not about the process but that we didn’t know about it, and it hadn’t been reported, and I still don’t understand why we weren’t told.”

He added: “People were surprised that the council bought this – it was on sale for quite a long time before the council bought it, and I am certain there was no other buyer. The building hasn’t generated the profit and footfall and turnover that it was expected to do, and even with the present tenants, there is a possibly we can talk to them and discuss how we may adapt the building so it fits in and compliments all the other developments on the Queen’s Drive area.

The cabinet agreed to note the report around the process of the acquisition, and that a further report over the future of Ocean would come back to the cabinet at a later date.

Misconduct inquiry into suspended chief constable suspended

Misconduct inquiry into suspended chief constable suspended

Good time for dolphins in Torbay

Good time for dolphins in Torbay

Shoplifting and violent crime up in Devon and Cornwall

Shoplifting and violent crime up in Devon and Cornwall

Riviera Airshow fit to fly

Riviera Airshow fit to fly

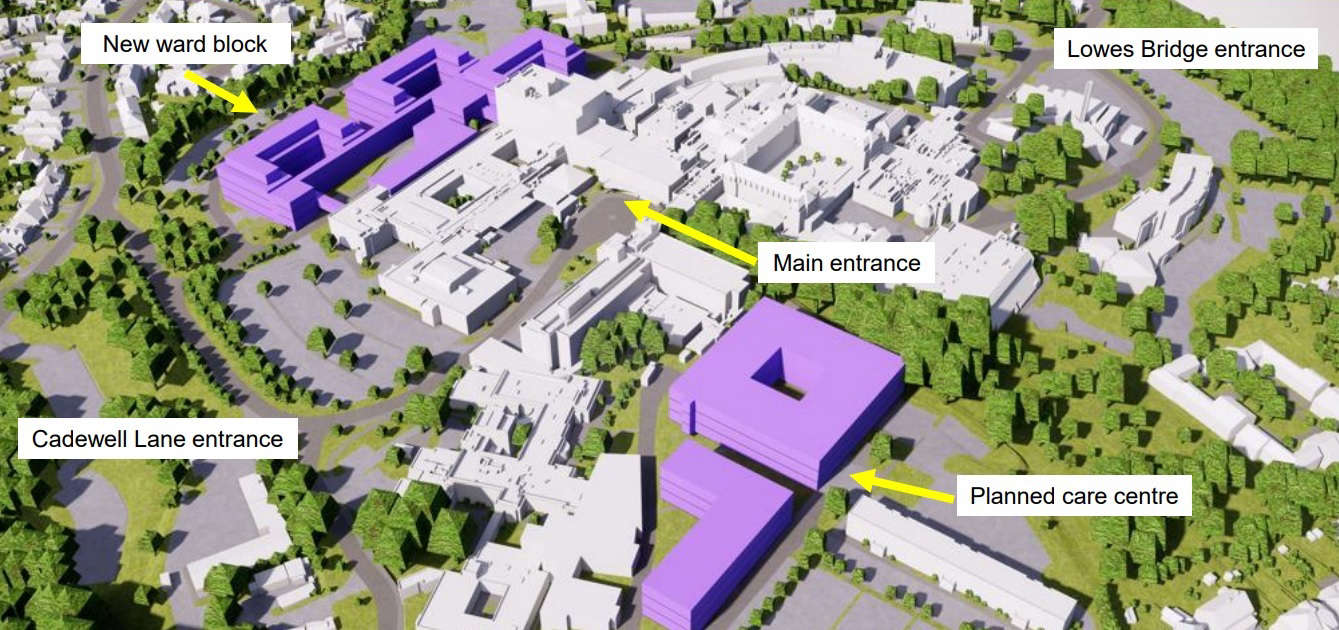

How Torbay Hospital bosses are tackling 'risks'

How Torbay Hospital bosses are tackling 'risks'

RD&E and North Devon hospital waiting times slashed

RD&E and North Devon hospital waiting times slashed